Welcome back to the Smallcap Discoveries / Espace Microcaps joint 3-part series on Investing in the Software-as-a-Service (SaaS) space.In Part I we started high-level with the SasS industry. We learned what SaaS was. We looked at the benefits the model has over traditional on-premise software deployment. And we looked at why the market is paying big multiples for these companies.In Part II of our series, we are focusing on SaaS in the smallcap space. We are talking the challenges these companies face but also the huge opportunities we’ve seen come out of the space. And we are finishing with an exclusive management interview of one SaaS company that has us interested.Challenges in the Smallcap SaaS SpaceBecause of their size, smallcaps can usually grow much faster than their larger peers. Think of a tiny SaaS company doing $1M per year in revenues that lands a $1M contract. The value of this business has doubled overnight — and probably even more because of scale. We’ve seen it happen more than a few times.

We watched Solium Capital (SUM.V) go from under $2.00 in 2012 to almost $8.00 today. Solium Capital sells software that automates employee stock option administration and accounting.

So the SaaS space produces some of the biggest winners in the smallcap world. But there’s a catch..

The SaaS model almost guarantees cash burn for a period of time. This means SaaS companies need outside funding to survive until they reach scale. But smallcaps are the furthest from scale AND often have the hardest time accessing public funding. This can spell big trouble for investors.

SaaS Model – Cash Burn

So why does the SaaS industry operate at a loss?

The first reason is to maximize growth. If the return on sales and marketing is attractive, then it makes sense to reinvest all profits back into the business. This lets a SaaS company maximize their growth and market share. Investors love this scenario.

Public SaaS companies spend about 40% of revenue on sales and marketing. On the other hand, traditional on-premise software firms spend only about 20-25% on sales and marketing (according to The Software Equity Group).

So the on-premise growth rate is much slower but they have better margins. In addition, on-premise software companies spend around 15% on R&D compared to 17%-22% for SaaS.

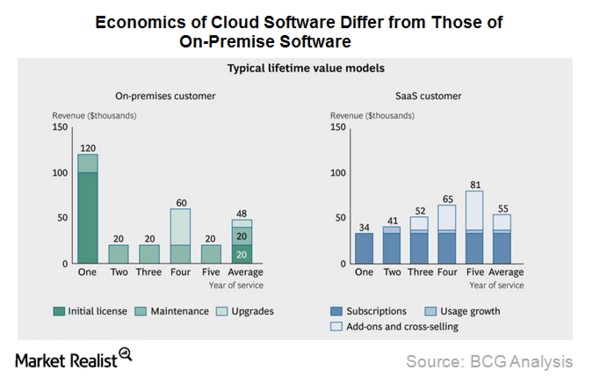

The second reason why SaaS companies operate at a loss is because the Customer Acquisition Cost (CAC) comes before revenue. They spend all their dollars up-front to acquire a new client but revenue is recognized over the lifetime of that client. With on-premise, the bulk of revenue is recognized up-front.

These two charts give you an idea of the timing differences for revenue:

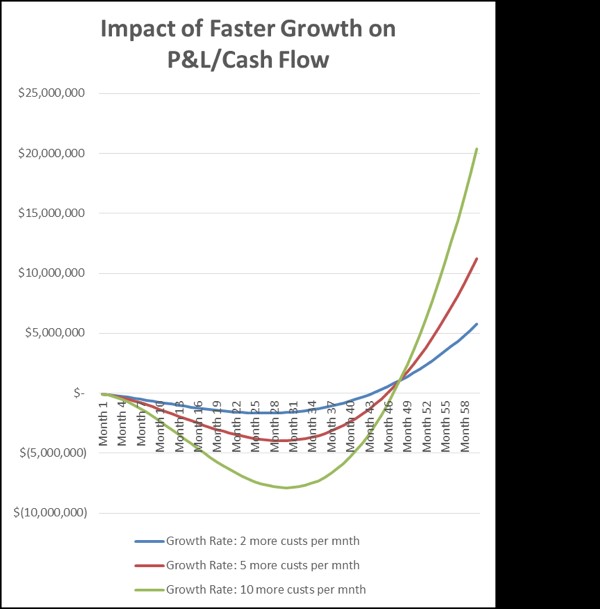

By selling a license, the on-premise company is profitable at year one. The more licenses it sells, the more profitable it will be in the short-term. But as soon as the flow of new licenses stops, the revenue and profit drop off abruptly and the maintenance contracts kick in.The SaaS model provides a smoother revenue flow. But for the SaaS company, the faster the growth, the less profitable it will be in the short-term. David Skok from Matrix Partners ran a model showing the impact of adding more customers per month, all else being equal:

So SaaS companies are left with an interesting conundrum: the faster they grow, the more money they lose. If a company can find investors who don’t care about short-term profits, they they can often capture a large part of their market. But for many smallcaps, these investors can be hard to find.To understand this challenge, we sat down with one SaaS smallcap that is becoming a rising star in the industry. We had the pleasure of speaking with Steve Levely, CEO of Ackroo Inc. (AKR.V, VEIFF:PINK). Ackroo offers a SaaS model that delivers clients gift card and loyalty solutions designed to increase customer retention.Steve took the helm of Ackroo in May 2014 and led the company back from the brink of bankruptcy. Ackroo has been one of the best performing Canadian SaaS companies this year, with shares up over 200% year-to-date.To learn how Steve and his team did it, read on. Audio of transcript is here.

Interview Good afternoon everyone and I’d like to welcome you all to the 2nd installment of the Small Cap Discoveries Management Webinar Series.My name is Brandon Mackie and I’m the co-writer of the Small Cap Discoveries newsletter along with Paul Andreaola.Small Cap Discoveries is a newsletter dedicated to uncovering Canada’s premiere emerging growth stocks. I’m joined today by Philippe Belanger founder and writer of the Espace MicroCap blog. Philippe is a full time investor and was recently recognized in Money Sense for growing his tax free savings account to over $100,000 exclusively through small cap trading.

I’ve know Philippe for a long time and pleased to be collaborating with him on this series.

Philippe: It’s good to be here.

Brandon: Today we’re talking about software as a service or SaaS industry. The SaaS model is a method of selling centrally hosted software on a subscription basis. It has been called on demand software and allows clients to access the software via a web browser.

The SaaS model is disrupting traditional software deployment and has been serving up big profits to investors riding this wave. The SaaS model offers exactly what the market craves – high margins and recurring revenues. And companies showing high growth have been awarded massive multiples to market.In the US for example, you have Work Day and Fire Eye, both trading at almost 18 times revenues. We’ve also seen some big winners come out of the small cap arena. We watched Solium Capital, ticker SUM on the Venture, go from under $2 in 2012 to almost $8 today.

So investors who know what to look for can make huge profits in the SaaS space. It’s one of our favorite places to go hunting for new ideas. But the challenge with the SaaS model is it almost guarantees the company will have negative cash flows for a while, of the 4 to 5 years. And funding this cash flow gap can be especially hard for small caps.

So we’re here today to talk about one small cap company in particular that’s becoming a rising star in this space. We’re talking Ackroo and Ackroo trades on the TSX Venture under the symbol AKR. Ackroo offers a SaaS model that delivers clients gift card and loyalty solutions designed to increase customer retention.

So full disclosure before we begin. Paul and myself have no position in the stock and Philippe has long shares of Ackroo. Now we’re pleased to welcome Steve Levely CEO of Ackroo.

Steve has over 15 years of sales and marketing experience and was promoted from Executive Vice President of Sales to CEO of Ackroo in May 2014. Ackroo is having a strong year under Steve’s leadership. Shares are up almost 200% year to date. Steve welcome to our webinar.

Steve: Thanks for having me guys.

Brandon: Can you talk to us high level for a moment and describe what solutions Ackroo offers and how they use the SaaS model to deliver them?

Steve: As you mentioned earlier, the SaaS model has become a popular driver for pretty much our whole industry.

If I look at any of our direct competitors everyone has moved to that strong recurring predictable revenue model that allows you to grow your business.

For us, all of our solutions whether they are our gift cards, our loyalty or even our promotional currency solutions all lead back to that subscription model where every time there is a customer swiping a transaction into a point of sale terminal we either put people into flat monthly plans or they will actually pay per transaction with minimums.

So for every transaction that actually happens in the marketplace we put all our customers into that flat rate predicable monthly fee that allows us to build and scale out our business.

Like you mentioned, it’s more of a pay later model but what it does for your business is it gives you that predictability from a cost standpoint to scale in over time.

So all of our solutions relate back to the SaaS model, even right down to the peripheral things we’re doing right now from a licensing perspective.

Brandon: Great. Take us back for a second and when you came on as CEO the company had just lost $3.9 million in 2013 and had just $250,000 in the bank. What were the challenges you faced coming on and how did you get the company back on solid footing?

Steve: The early phase, and I think you mentioned it earlier, that companies go through is 4 to 5 years of losses before you actually turn the corner and we’re at the just over 3 year mark now.

It’s where you go through that whole stage of validation of your business.

So we went through lots of learning’s from a cash perspective of where we were spending and where we were trying to scale and we did a lot of scaling too fast.

When I actually took the chair a little over a year ago we actually had even less than $250,000 in the bank, we were down to zero dollars at the time.

We were actually on our line of credit when I actually got the keys.

I took the actual helm in May and we were at $250,000 at the end of Q1 and so we were completely out of cash when I started.

So the challenge was how do you keep the business moving forward?

So first thing we did is I reached out to our current investors and asked them to provide us some working capital to give us time to start looking at restructuring the business.

So we were fortunate that our current investors stepped up and added $400,000 into the business in June of last year and provided us the time to figure out what to do next.

The first thing we did was we looked at the cost structure of the business and we looked at every area as to where we could actually reduce costs but also maintain revenues.

We knew we were going to affect our growth and wanted to make sure we at least retained our revenues.

So first off we got that working capital put into the business to buy us some time. Then we made some steady deep cuts into the business.

Not one huge deep cut that was impossible to recover from but steady sharp cuts into the business that allowed us to kind of heal quickly and keep moving forward.

That allowed us some time to figure out operationally how to make change within the business. But the 2nd thing we needed to do was to actually look at the actual corporate structure.

At the time we had almost 70 million shares issued. So not only were we broken in regards to a bloated structure of the company and having to get that tighter and leaner as a business, but also maintaining the growth of our product and the growth of our business, but we also had to look at the share structure.

So we had to work with our Board and ended up issuing a request to our shareholders to do a 10 to 1 rollback to allow us to effectively restart the company, if you will.

We did a 10 to 1 roll back that was approved at the end of November, which was instantly followed by a financing and that financing helped us payoff a little bit of the debt we had accrued to get there, but also provided us the working capital to actually keep executing.

So we were very fortunate that our shareholders saw the value in not just driving costs down in the business but also restructuring the business to give us a chance for success.

So we’ve done that and we continue to make small strategic cuts in the business and at the same time got through this restructuring and financing which closed in January of this year.

Now we’re actually in a position where we can continue to accelerate and grow the business.

So tough times but again we had to look both inside and outside the business in order to get there. That’s how we did it.

Brandon: It’s been quite a turnaround.

Steve: We aren’t completely out of the woods yet but yes there’s been lots of progress.

Brandon: Steve I have a question, the average SaaS company spends roughly 40% on sales and marketing while Ackroo would do a sale spend of almost 98% over your last quarter. Can you talk about what’s unique in your model and how you grew while spending so little on marketing?

Steve: It’s one of the biggest cost reduction areas we made in the business where we listed the different departments and traditionally you have an R & D department, a sales & marketing department and an operations department.

We wanted to look across the business and I actually did a lot of homework across the industry to see what was out there and I found that there are a number of companies that have moved from a sales and operations being separate to being together.

So it’s a sales operations model and so combining the 2 entities together.

Our business has a cost to support our customers and to support our channels and so what we did is we began teaching our operational people how to also be salespeople and to actually develop and grow our customers, to retain and grow our relationships with our channel partners and grow from there.

We continue to sort of tweak that model and we’re now starting to hire in salespeople and teaching them how to do operational tasks as opposed to taking the operational people and teaching them sales tasks.

So we’re working through that model but what it’s allowed us to do is it’s allowed us to substantially reduce the actual sales and marketing costs because we’ve just taken the administrative costs of the business that are required and we’re taking those costs that are fixed for the business and turning those individuals into revenue generating individuals.

We’ve seen other people in our space do it and so we’ve adopted it and put our own little twist on it and that’s what is going to allow us to keep executing. We will have to do some type of marketing again in the future but from a sales and operations perspective by bringing it together reduces overall costs and I actually believe we’re getting more bang out of our buck.

We’ve got a tighter relationship with our customers from a referral and growth standpoint than we ever had and our channel partners prefer our sales operations team that is reaching out to their customers as they’re even more knowledgeable because they understand how to set up, deploy, support and train our customers so they’re even more skilled than our traditional salespeople were.

It’s been a very smart pivot for us that we continue to work and tweak to make it better but we’ve had plenty of progress. So I’ve been very satisfied with the change and that’s why we made it.

Brandon: Great. One of the biggest challenges for small cap SaaS companies as we’ve discussed is the time it takes to become cash flow positive. You’re 3 years in now so how do you manage this challenge and ensure your company has adequate funding to reach profitable operations?

Steve: It’s probably the number one thing that any small cap or micro cap company should be thinking about is cash.

We review our cash on a weekly basis. Cash is king in every business but it’s especially in a small cap business that is still not at profitability.

So you have to have a constant eye on it and the traditional model is to avoid death by 1000 cuts, which I actually disagree with.

I think if you’re doing smart strategic cuts to the business where you’re trying to reduce costs while maintaining growth of the business as well I think it is a smart way to do it.

So we’re constantly forcing ourselves to look at every area of the business. Every cost that we have, what kind of return on investment are we getting for that person’s time?

We’ve been under constant analysis and so the cash constraints as much as they’re difficult on a business it’s actually been one of the best things for us that we didn’t have this unlimited cash in front of us because it stops you from doing things like scaling too quickly and over hiring. It forces you to be really prudent with how you’re managing yourselves.

So how we’re managing it is just that, we’re very tight on our budget and as much as we have great investors and we had financing in January and we have warrants that are slowly starting to trigger so we know we have access to capital, but we’re not in a rush to have millions of dollars in the door today because we’re managing it as if it’s not coming in and we’re managing ourselves on a month to month and bi-weekly to bi-weekly basis to make sure that we’re doing all the prudent things in the business.

And any time we can reduce costs while still maintaining our growing revenue we do it.

Brandon: And talk about the advantages of using a SaaS model in particular in your space? What advantages do you have over loyalty providers using a traditional on premise deployment method?

Steve: I think what you’re seeing is the SaaS model, as you mentioned, especially in our industry has become quite popular and traditional SaaS is the subscription based model.

So it’s not transactionally based because you have this fixed amount of revenue that’s growing your business.

A lot of the investment models even in the payment space is sort of a pay as you go. So there is risk to that because you can’t really control that revenue and it becomes a little less predictable.

Whereas having these fixed rate subscription agreement models, you can kind of really predict your business short term and long term into the future.

So it’s an advantage over some of the traditional pay as you go or per transaction models by going there. Most of our direct competitors are moving in that direction or are already there. But it’s our indirect competitors that are doing more of the on premise deployments.

And if you look at the point of sale software companies out there those are the individuals that still have thick client environments where they’re limited to that localized environment.

So to really dumb it down, so to speak, if you think about point of sale systems that work in a single business that business can’t communicate with other businesses; whereas our product can do that.

We have the ability to connect 2 businesses together and it allows us to do things called “coalitions” where you mix 2 businesses with a co-branded program together. It allows us to do things like distribution where we’re selling gift cards for our customers in other environments.

So the thin client model we have allows us to do that; whereas, you have some people in the space and I call them “indirect” competitors like the point of sale software companies that are starting to sell gift card and loyalty modules but they’re going to be limited.

They won’t be able to spread their wings into multi-business to allow a lot of the features and functionalities that a lot of merchants are looking for today.

So it sort of creates a stronghold for 3rd party providers like Ackroo is in order to be able to provide that extra step of growth opportunity for our merchants.

Philippe: Steve now that you’ve made 2 acquisitions as CEO can you talk about how these have gone and what opportunities you see for further acquisitions in the SaaS space?

Steve: I’ve been very happy with both acquisitions and maybe I’ll talk about each one separately. PhotoGiftCard the strategy there was a number of things but one of them was to get into a complimentary business. We had looked at our gift card offering and wanted to round it out and we wanted to get into distribution.

That’s where we have the ability to sell our customers gift cards in other environments and get a commission for it and creates another revenue stream.

Photo Gift Card has that through the PhotoGiftCard online mall which was our first step into distribution, which we took the next step later on with Blackhawk Network where you see cards going into the Loblaws of the world etc.

So distribution was the next big step we needed to make for our gift card business and we were happy to do that.

It was also the right price because of the ownership and what they had done for the business from a valuation standpoint. And most importantly they had a great list of customers that we continue to work with.

The challenge there has been the technology and implementing that technology into our environment and operationally taking over the business.

They had outsourced all their products overseas and operationally they had just a handful of people doing so.

So we’ve had to take that product all in-house and operationally take it all over completely and move offices from Vancouver to Ottawa and so it’s been cumbersome.

So the last quarter has been really challenging for us managing the integration of that. So one of the key learning’s was expecting and understanding there was going to be an operational strain on the business in order to do these acquisitions. So short term pain but for long term gain.

Dealer Rewards is very new to us now and once again I was very happy with the structure of the deal itself. It brings in a lot of SaaS business into the company. It’s a fixed loyalty business as well.

What was great about them is not only do we end up taking on great customers and revenues but we got some great talent, talent that’s allowed us to do some other restructuring within the business because the talent was so strong and their business was very aligned with Ackroo.

They had an exact sales operational model like we’re running today so culturally it was a very simple fit.

So what it allows us to do and what we’ve learned is the valuations we gave and the deal structures we’ve created in both of these scenarios is to look for more of these in the future.

And when it comes to talent acquisition it’s almost ideal that you kind of have cultures that work similar so the integration of the 2 companies is not painful. It can be quick and be brought right into the business so that you get this SaaS recurring growth, you get an operational change that’s minimized and then you get upside through talent.

So what we’ve learned through the first two is what to look for in the next two. So we actually feel it’s been very successful, although lots of work, but we’ve been very happy with the progress so far.

Philippe: One last question from me, how do you use key metrics like customer lifetime value and customer acquisition costs in your analysis of Ackroo and other businesses you’re looking at acquiring?

Steve: We’re a very metric driven business and you’re starting to see a number of these metrics through our investor decks.

We’ve been trying to provide some guidance to the market around the key metrics of our business and a lot of the items we analyze internally within the company and stuff like our attrition rate is really critical.

Knowing that we’re maintaining a less than 10% churn rate suggests potentially we’re retaining customers for 9 years and so for losing 10% you can argue its 9 years.

But what we do is we model half that result and our internal modeling is based on 4 ½ to 5 years.

So we look at it saying if we’re assuming our customers stay with us for 4 ½ to 5 years, because we really haven’t even been around for 4 ½ to 5 years yet to really know, but we’ve done all our modeling there and then as we looked at our costs of sales which isn’t as obvious to the market because now that we’ve taken away sales and marketing from a financial statements perspective there are costs within our administrative costs now to operations and commissioning and paying our channels that is there.

So we’re actually able to have a really good understanding of our true cost to acquire, what we believe our lifetime value to the customer is and we always want to make sure we’re better than one-third.

So if our lifetime value is $3,000 I want to make sure our cost to acquire is less than $1,000. So we’ve been trying to work in that model where it’s at least one-third and its actually much less, our cost to acquire is less than that 30% goal that we’ve had for ourselves which is a good sign for the business.

Knowing that our customers are 4 ½ to 5 years in the current modeling, to have them pay off in the first 12 to 18 months is a good victory for the business where you then get 4 years of true profits on their payments into you.

So that actually plays into when we are analysing other acquisitions, just like that as well and the attrition level is big. We’ve looked at companies like the people in the debit/credit space and attrition there is massive.

You’re talking 30 to 40% sometimes versus our less than 10%. So buying the debit/credit companies, the valuation isn’t as high in our opinion because of that turnover especially when you change hands.

So we know that in our specific specialty payment space attrition is critical and looking at the historical amount of attrition is the first metric.

We understand our own cost to acquire and so I’m not as concerned about the acquisitions cost to acquire because we understand our own but I am really interested in their lifetime value of their customers when we’re looking to do an acquisition and how it relates to the churn they have.

Philippe: Thanks Steve.

Brandon: Last question from us Steve. What milestones should investors be looking for in 2015 and beyond?

Steve: I think the biggest and most obvious one, and I’ve been providing a bit of guidance to the market, is that we’re striving to have our first profitable quarter this year.

Our goal is that Q4 we’ve got a profitable quarter to boast on and hopefully it’s a big enough quarter to make up for the losses happening earlier in the year.

So the biggest and first metric is turning that first profitable quarter. Beyond that it’s year over year growth.

I’ve been in the job for a year now and the market should start looking at our quarters year over year now and what are we doing from a year over year basis with regards to revenue growth and cost control and location growth because as we’re growing our footprint and expanding our business it’s a very important metric.

The other last one is the revenue metrics around that.

So I’ve provided a bit of guidance in our investor decks around the revenue we get per current customer and per new customer and seeing those metrics either sustain or grow would be the positive metric to look for and milestones of the business that the investor should be looking at.

But those are the big key ones for us, look at year over year growth, look at our first profitable quarter and then again look at how the key metrics of our business are trending. If people have their eyes on those pieces they’ll understand all the good things we’re doing and the great direction we’re headed in.

Brandon: All right well it should be an exciting 2015 and we wish you the best of luck. That’s all the time we have for today and we’d like to thank Steve Levely of Ackroo for coming on to share his company’s story with us. And we’d like to thank all the Small Cap Discoveries and the Espace Microcap followers for tuning into this webcast.

So the bottom line is Smallcap SaaS companies have their own unique challenges. But as AKR and SUM have shown us, investors who know what to look for can reap big profits.In Part III of our SaaS series, we are going to pull it altogether for you. We are going to cover the metrics you need to know for every SaaS company you invest in. And we’re going to tell you exactly what you need to see to position yourself for profits.

Smallcap Discoveries is a newsletter dedicated to uncovering Canada’s premier emerging growth stocks. Smallcap Discoveries focuses on growing smallcaps with positive cash flow that have gone undiscovered by the broader market. Smallcap Discoveries was created as platform to share actionable ideas and help retail investors get an edge in the markets. Smallcap Discoveries’ mission is to bring the world the best original research, on-the-ground due diligence, and profitable ideas in the smallcap space. If you’re an avid smallcap investor, Join Us.

Espace MicroCaps is a unique community of microcap investors in Canada. The Espace Microcaps community is dedicated to sharing high-quality research on Canada’s most promising public firms to a network of long-term growth investors. Espace Microcaps’ Mission is to publish educational content and investment ideas from the best microcap investors in Quebec and Canada. https://espacemc.com/.