We are generally industry-agnostic when picking stocks at Smallcap Discoveries. We will look at anything except resource stocks.

It’s interesting to us however that one industry produces more companies in our sweet spot that just about any other. It’s the Software-as-a-Service (SaaS) space.

These companies have exactly what the market craves: recurring revenues, high margins, and almost unlimited scalability. They can command some of the highest valuations in the market. We’ve seen some huge winners in the space over the last few years.

What excites us is this industry is going through a massive change. Many traditional software companies are transitioning to a SaaS model. The switch temporarily disrupts the numbers — but it creates some great opportunities for investors who understand the space.

Well today we are pleased to introduce an SCD-exclusive 3-part series on investing and profiting in the SaaS space. And we’ve done it in collaboration with two of our good friends from the smallcap world: Philippe Belanger and Aaron Lanni.

Philippe and Aaron write a smallcap-focused blog, Espace Microcaps, and are pretty darn good at what they do. Philippe was recently profiled in MoneySense for growing his TFSA to over $100,000. He’s done it exclusively with smallcap investing.

We’ve known these two for a few years now and had a lot of fun collaborating with them on this series.

We’ve split this SaaS series into 3 parts:

Part I – SaaS Overview: What it is, how it differs from traditional software deployment, and how these companies are valued.

Part II – SaaS in the Smallcap Space: The unique challenges and massive opportunities in smallcap SaaS companies. An exclusive interview with the CEO of one SaaS smallcap that is becoming a rising star in the space.

Part III – SaaS Metrics & Investment Strategies: We boil it down to the key metrics you need to know and what you need to see to position yourself for profits.

So we invite you to read on as we go through the SaaS industry and explain exactly what you need to know to profit in this exciting space.

Part I: Investing in SaaS Companies

We’re starting with the basics in Part I of our SaaS investing series. We’ll be talking what SaaS is and how it’s disrupting traditional software delivery. We’ll finish with some of the key advantages of SaaS and why it’s getting a premium valuation in the market.

What is SaaS?

The SaaS model is a method of selling centrally-hosted software on a subscription basis. It has been called “on-demand” software and allows clients to access the software via a web browser. Hosting software off-premise has often been referred to as cloud computing.

Here’s how Forrester Research defines cloud computing: “… a standardized IT capability (services, software, or infrastructure) delivered via Internet technologies in a pay-per-use, self-service way.”

Cloud computing allows you to access programs over the internet instead of on your hard drive. Online banking and e-mail are common examples.

To illustrate the advantages of cloud technology, let’s first look at how software is traditionally delivered using the ‘’on-premise” model:

- The vendor develops software and installs it on the customer’s hardware, at obviously, their place of business.

- The software is hosted on the client’s server and managed by the client’s internal IT department.

- The software is sold through a perpetual license that the client pays up-front. As the client’s business grows and adds more staff or new software components, additional licenses need to be purchased.

The vendor also requires annual maintenance contracts to cover support, updates, and patches. These contracts are typically priced at 15-22% of the initial license cost.

On-premise software is usually more customizable but the more you customize, the more it will cost you in upgrades. Implementation and integration can be lengthy and costly but the client has more control over the systems and data.

Now let’s take a look at how cloud technology paved the way for the new model called “Software-as-a-Service” (SaaS):

Cloud computing can be seen as a stack of three elements:

Source: Rackspace

- Infrastructure as a Service (IaaS): the hardware and software that powers it all: servers, storage, networks. Amazon Web Services and Rackspace (RAX:NYSE) are examples.

- Platform as a Service (PaaS): the set of tools and services that allow the creation of applications delivered over the web. Google App Engine, Microsoft Azure and Force.com (from Salesforce.com (CRM:NYSE)) are examples.

- Software as a Service (SaaS): the final application delivered to you over the web on a “pay-as-you-go” subscription basis. Examples include Workday (WDAY:NYSE), NetSuite (N:NYSE) and Veeva Systems (VEEV:NYSE).

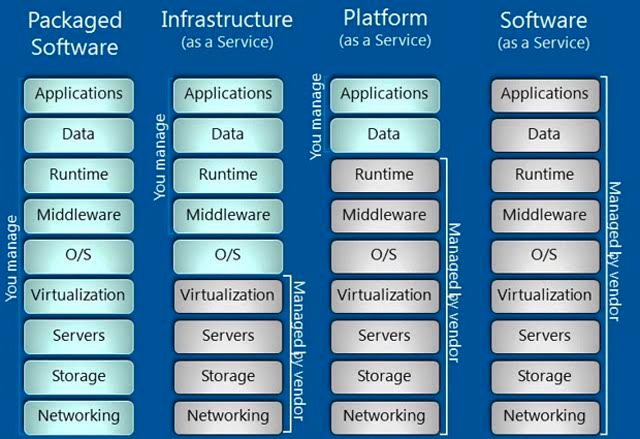

Here is another way of looking at the stack and comparing it to on-premise software (far left):

(Source: Venturebeat.com)

In the SaaS model, the software vendor hosts and maintains the server, databases, and code that make up the application. The buyer is outsourcing all hardware and troubleshooting to the vendor.

Benefits of the SaaS Model

SaaS comes with many benefits compared to on-premise software. Here are just a few:

- Lower upfront cost: lower initial setup costs, no upfront license fee, and much lower hardware costs. SaaS allows a company to move IT from a capital expense to an operating expense.

SaaS vendors price their application using a monthly or annual fee based on usage ($20/month/user, for example). This means small businesses can now afford an enterprise-class technology. It’s also easier to budget. - Lower Total Cost of Ownership (TCO): Studies have shown that SaaS lowers TCO compared to on-premise, especially when factoring in the opportunity cost of the high up-front expenses associated with on-premise. For example, these up-front costs can instead be used to hire additional employees that could bring in revenue starting the first year.

- Updates and security are outsourced: the vendor is responsible for software upgrades and ensuring the applications are secure and backed-up.

- Mobility and flexibility: You can access the software via mobile devices anywhere as long as you are connected to the Internet. You can scale your business faster with a cloud vendor since server capacity is not an issue.

The software is already configured and installed, allowing for a quicker deployment as you hire new staff. Many SaaS vendors also offer free trials of the software so you can test it before buying.

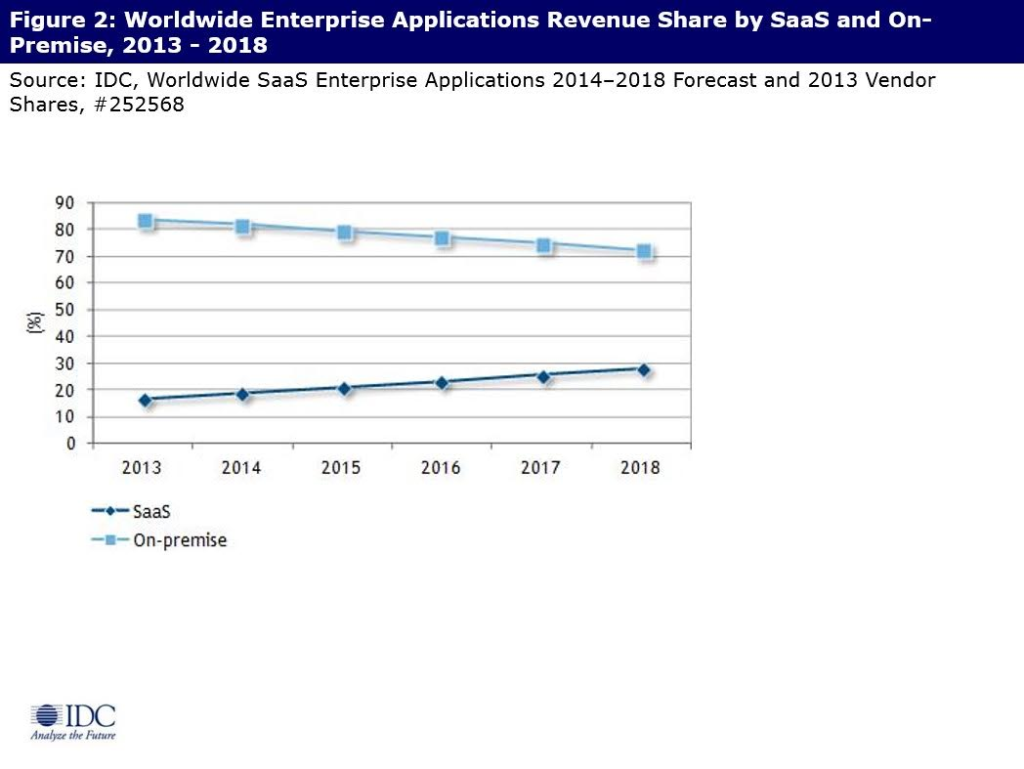

The following graph illustrates how traditional software sales still dominate the market:

Over the next five years, SaaS revenues are forecast to grow at 17.6% per year compared to 3.1% for on-premise (according to IDC). This will enable the SaaS penetration rate to increase from 17% (2013) to 28% (2018) of total software sales.

Few industries are growing at double-digit rates and these projections put the SaaS industry at one of the fastest growing we’re aware of.

Valuation of Software Companies – SaaS vs On-Premise

Now we’ll look at some valuation metrics — and understand why SaaS companies are trading at a large premium to their on-premise peers.

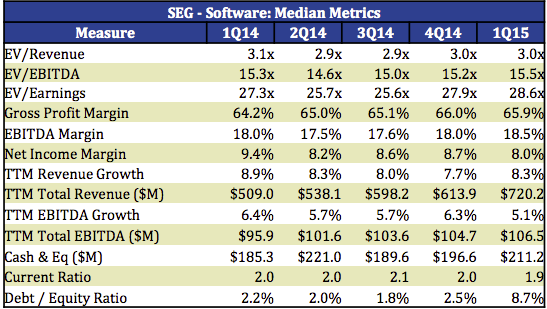

The Software Equity Group provides free research on software companies. They follow an index of 141 public companies that offer on-premise software on a perpetual license model with annual maintenance and service contracts.

Here are the median valuation metrics for that index:

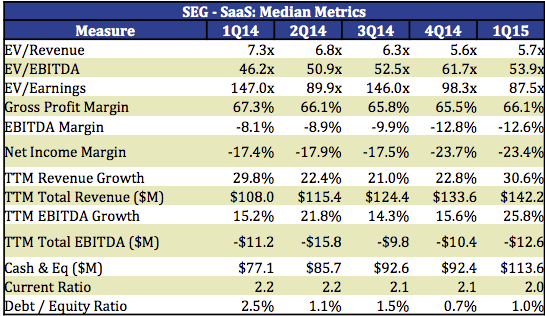

The Software Equity Group also tracks an index of 52 publicly traded pure-play SaaS companies. Here are the median metrics for that index:

What really stands out is the median EV/Revenue multiple for traditional software companies is about half the multiple of SaaS companies. Here are the three primary reasons:

SaaS revenue is growing at 25-30% while on-premise is only growing at 8-9%.

- SaaS companies have a much higher proportion of recurring revenue. The market is willing to pay up for that predictable stream of income.

- The market sees a brighter future in the cloud business model for reasons noted above.

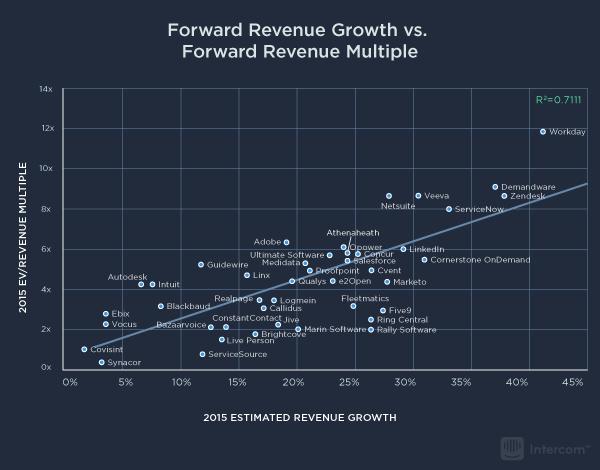

To see the correlation between growth and valuation, Intercom studied a few SaaS companies:

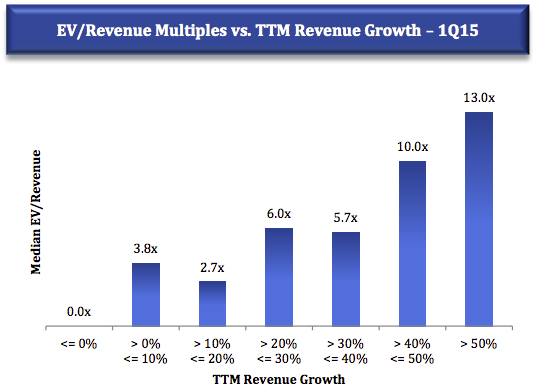

In addition, here is the distribution of growth rates compared to EV/Revenue for the SEG SaaS Index:

It’s very simple for these companies: the higher the growth, the greater the valuation.

Bottom Line

The SaaS model is disrupting the software industry and serving up big profits to investors riding this wave.

Companies love SaaS because it’s:

- Cheaper — both in up-front cost and total cost of ownership

- Flexible — the software can be accessed from any device, updates can be pushed from the web instantly.

And investors love SaaS because of their:

- Growth — SaaS is taking market share and growing 2.5-3.0X the average on-premise software company.

- Recurring Revenues — predictable revenue streams mean less earnings surprises and a clear path to growth and profitability.

So put it all together — and you get valuations for SaaS companies over 2X that of traditional software companies.

But investing in SaaS companies comes with its own challenges. Almost 55% are unprofitable and most require 4-5 years to reach profitability. This can be especially challenging for the smallcaps we focus on.

In Part II of our SaaS series, we’ll focus on the challenges facing smallcap SaaS companies — and the enormous opportunities this space brings investors. We’ll also get an exclusive CEO interview from one smallcap SaaS company that is making a splash in the industry.

Smallcap Discoveries is a newsletter dedicated to uncovering Canada’s premier emerging growth stocks. Smallcap Discoveries focuses on growing smallcaps with positive cash flow that have gone undiscovered by the broader market. Smallcap Discoveries was created as platform to share actionable ideas and help retail investors get an edge in the markets. Smallcap Discoveries’ mission is to bring the world the best original research, on-the-ground due diligence, and profitable ideas in the smallcap space. If you’re an avid smallcap investor, Join Us.

Espace MicroCaps is a unique community of microcap investors in Canada. The Espace Microcaps community is dedicated to sharing high-quality research on Canada’s most promising public firms to a network of long-term growth investors. Espace Microcaps’ Mission is to publish educational content and investment ideas from the best microcap investors in Quebec and Canada. https://espacemc.com/.