How many business do you know of that are capable of converting 75% of their revenues into free cash flow? Few businesses could even dream of achieving this feat – even Moody’s, the prototypical wide moat business, manages to convert “only” 35% of its revenues into free cash. Today we will present the only business we have ever come across capable of achieving this extraordinary measure of profitability – Pulse Seismic (PSD.TO $3.02, PLSDF $2.78), a Canadian small-cap operating in the oil & gas industry.

Pulse Seismic owns a vast library of seismic data that it licenses to oil & gas companies. The company owes its profitability to a unique business model that allows it to repeatedly license data at virtually zero incremental cost. The data requires little maintenance expenditure and holds its value over many years. The resulting economics are enviable yet the barriers to entry are extraordinarily high – management estimates recreating Pulse’s data library would cost over $3.5 billion dollars and require 60 crew-years. Considering these figures against Pulse’s current market capitalization of $220 MM makes this a wonderful little business worth exploring further.

Business Overview

Oil & gas companies use seismic data in conjunction with well-logging data and well core comparisons to create a detailed map of the geological subsurface at different depths. Oil and natural gas explorers then rank the attractiveness of their leaseholds and make hundreds of millions in capital commitments to new wells based on these seismic results. Due to the enormous capital required to drill new wells, oil & gas companies have virtually no choice but to use seismic data to select for economically attractive drill sites.

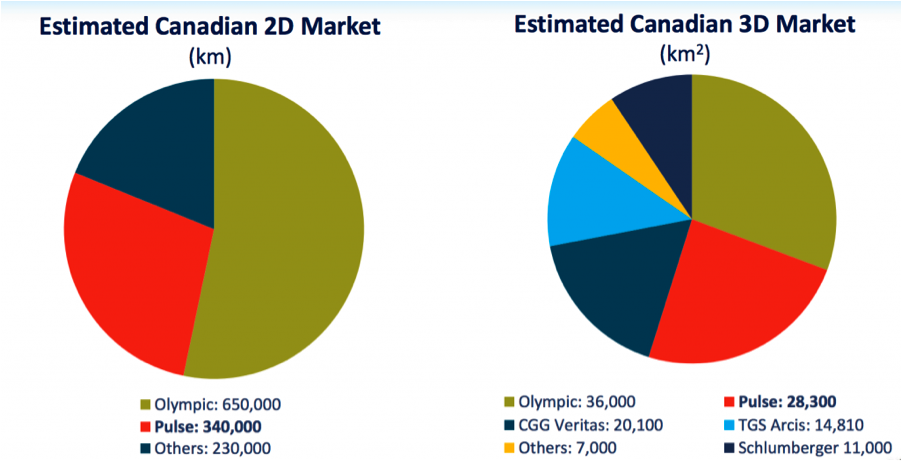

Seismic data is common in two forms, 2D and 3D. 2D data is measured in linear kilometers and provides a sectional illustration of geological formations on a straight line. This data is most useful for large-scale exploration and prospecting of potential areas. Targeted drilling often requires 3D seismic, which provides a more precise visualization of the subsurface geology. This precision is especially critical for the complex formations associated with the shale and tight oil plays that have driven a majority of the recent activity in Western Canada. Pulse actively acquires both types of data and at the end of last quarter had 28,000 km2 of 3D data and 340,000 km of 2D data, making it the 2nd largest data library in Canada:

The company expands its seismic library primarily through two methods:

The company expands its seismic library primarily through two methods:

Dataset Acquisitions – Pulse continuously looks to acquire proprietary 2D and 3D datasets when they are available at reasonable valuations. Over the years, Pulse has acquired vast amounts of high quality data from exploration & production companies, notably Chevron, looking to monetize their historical seismic shoots. Pulse is able to employ processing and visualization software to reprocess and reinterpret decade old data, creating an attractive cash revenue stream.

Participation Surveys – as the name implies, Pulse partners with select customers to fund the capital-intensive process of shooting new survey data in prospective areas. The deal is a sweet one for Pulse – they are able to command a pre-funding rate from their customers of 60%-75% depending on market conditions. Most enticing of all, Pulse retains full ownership of the newly acquired data and can license it on a non-exclusive basis to other customers. What company wouldn’t want to have two-thirds of their annual capital expenditures paid for by their customers!?

Shooting for new seismic data can typically only be conducted in the winter when the ground is hard. The process is quite expensive – 2D data shoots cost an average of $6,000/km and 3D shoots have run at just over $50,000/km2 based on data from Pulse’s most recent winter campaign. As a result, the company carefully selects only a few surveys to do each year that offer the highest return potential.

Business Model Features

Pulse’s extraordinary free cash flow margins arise from myriad unique features of the business model:

1) Highly scalable – Pulse’s data library is highly scalable – once they have the office space, administrative functions, and a capable sales force, the library can grow without the need to add to the cost base or invest in additional working capital. The cost of licensing existing data to new clients is negligible and Pulse achieves near infinite incremental EBITDA margins on these sales.

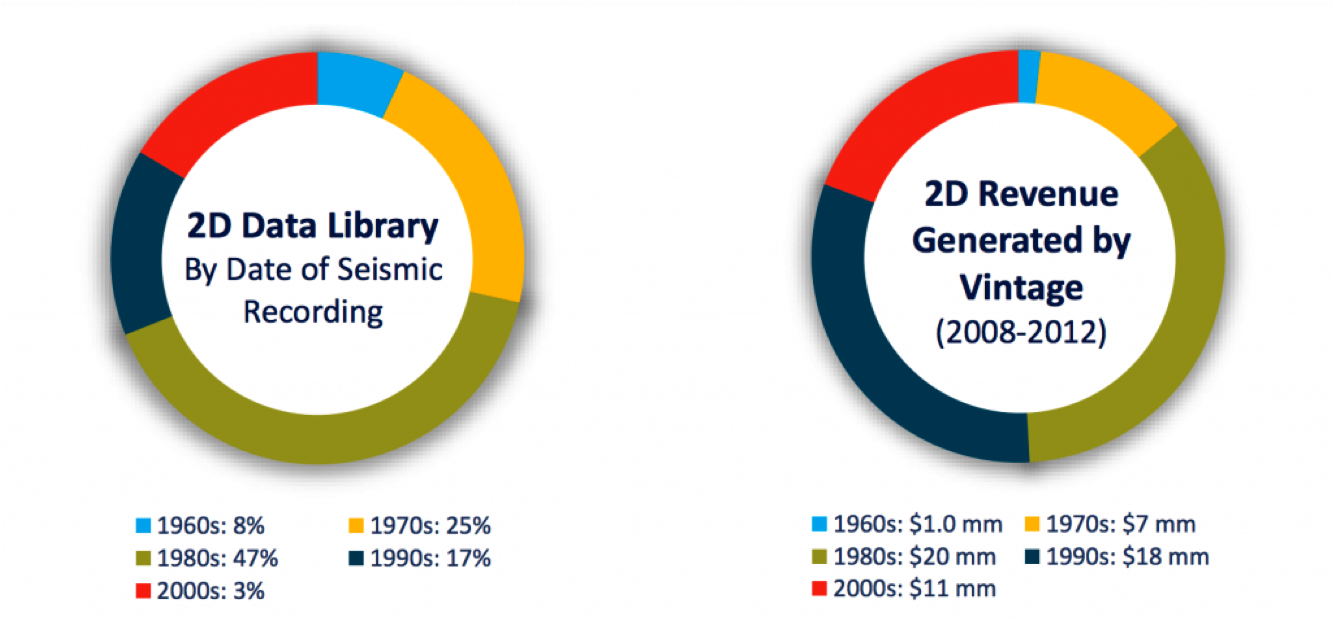

2) Low maintenance capital requirements – Seismic data collection technology has changed very little over the years, with the only major advance coming through 3D collection techniques. Pulse’s data does not “go bad” and has proven to hold its value over decades without requiring upkeep expenses, long after the GAAP amortization period of 7 years (more on accounting later). Pulse’s latest library sales data by vintage confirms GAAP doesn’t even begin to describe the economic reality of Pulse’s data:

Nearly 15% of Pulse’s recent 2D data sales come from data shot in 1960’s and 1970’s while data shot in 1980’s contributed 35% of the total. This data provides a valuable high-margin revenue stream that can be counted on even as Pulse transitions with the industry to a focus on 3D data.

Nearly 15% of Pulse’s recent 2D data sales come from data shot in 1960’s and 1970’s while data shot in 1980’s contributed 35% of the total. This data provides a valuable high-margin revenue stream that can be counted on even as Pulse transitions with the industry to a focus on 3D data.

3) Durable economic moat through geographic exclusivity – By its nature, seismic data is exclusive to a particular geographic area. If Pulse happens to own data covering a particular area, an oil & gas company wishing to explore that area likely has only one choice of where to buy the data. It makes little sense for a competitor to fund a survey on an area Pulse has covered and readily available for licensing. Over the years some overlap has occurred between competing data libraries, but Pulse estimates this figure is low (~20%), which helps abate competitive pressure and promote considerable pricing power.

4) Pricing power by providing mission-critical product– Pulse is able to command robust pricing through the mission-critical nature of its product. With well costs running an estimated $8-15 MM/well for unconventional resource plays, the cost of developing prospective fields can run into the hundreds of millions. Given an oil & gas company could bankrupt itself drilling without the geological definition that seismic provides, they have virtually no choice but to use seismic data.

Seismic costs typically represent ~1% of the total development cost. The asymmetric nature of the benefit seismic provides against its relative cost creates strong dynamics for pricing power. Consider this quote from CEO Neil Coleman on the 2Q13 conference call:

“So far, we’ve been able to strengthen our pricing for data throughout the first half of the year. Maintaining the pricing integrity of our asset base is a very important part of our long-term strategy for all of our stakeholders.”

Given a climate of high industry uncertainty, Pulse’s ability to raise prices provides convincing evidence of their strong competitive position.

5) High barriers of entry due to replacement cost of seismic library – The highly concentrated industry structure Pulse operates in is largely a result of the high cost of replicating a seismic library. Starting out today, a potential competitor would need to spend over $3.5 billion to recreate Pulse’s seismic library (using the previously referenced basis of $6,000/km for 2D and $50,0000/km2 for 3D). Beyond the sheer cost, seismic data can only be shot a quarter of the year during the winter, which means it would take over 60 crew-years to replicate the set. In fact, some of Pulse’s historic data covers geographically protected areas that would be virtually impossible to replicate due to environmental restrictions.

Adding to all these features, a concentrated industry structure keeps competition at bay and helps Pulse maintain its entrenched completive position.

Financials

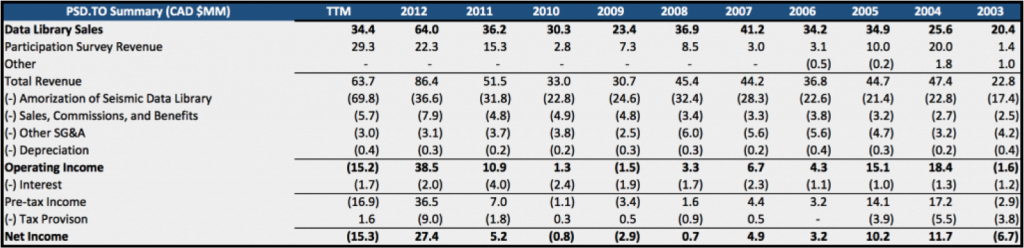

With Pulse’s unique business model explained, let’s have a look at the 10-year financials:

Strangely, the financials paint the picture of a hopeless, loss-making business. The accounting is a bit bizarre so an explanation is in order. When Pulse and a customer agree to perform a participation survey, Pulse will contribute say $3 MM while their client will put up $7 MM in a typical funding arrangement. The entire $10 MM is recorded as CAPEX under the investing cash flow section and the $7.5MM from the client is recognized as revenue on the income statement under “participation survey revenues.” The full cost of the participation is then added to the seismic library asset on the balance sheet and amortized as follows: 50% in the first year and the remainder ratably over 7 years.

Strangely, the financials paint the picture of a hopeless, loss-making business. The accounting is a bit bizarre so an explanation is in order. When Pulse and a customer agree to perform a participation survey, Pulse will contribute say $3 MM while their client will put up $7 MM in a typical funding arrangement. The entire $10 MM is recorded as CAPEX under the investing cash flow section and the $7.5MM from the client is recognized as revenue on the income statement under “participation survey revenues.” The full cost of the participation is then added to the seismic library asset on the balance sheet and amortized as follows: 50% in the first year and the remainder ratably over 7 years.

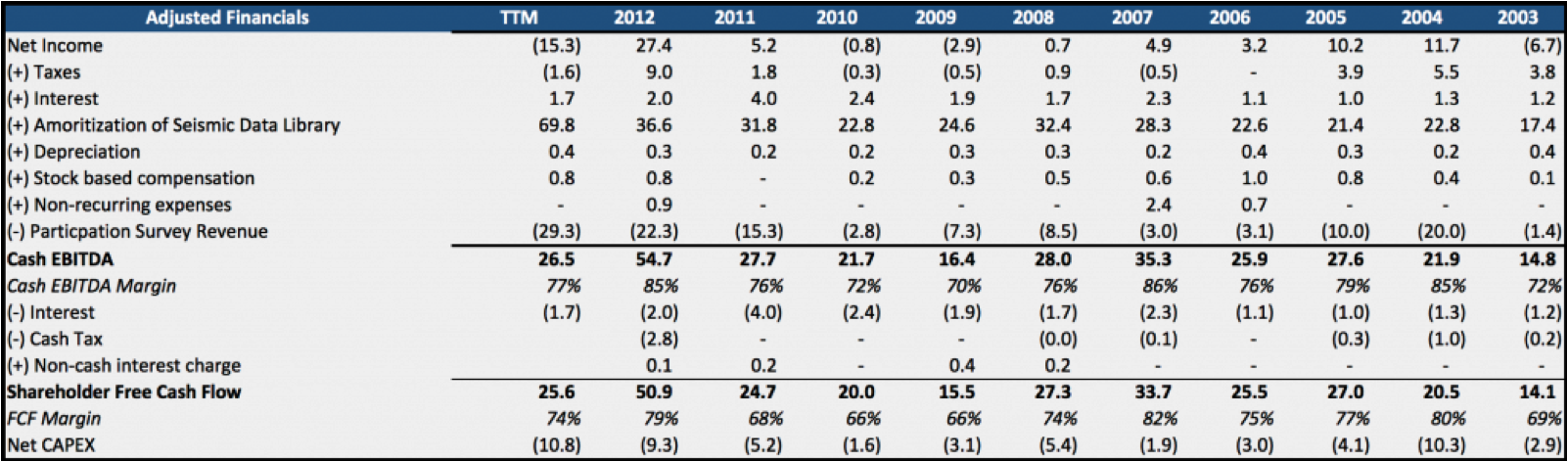

While these accounting conventions are standard in the industry, they are virtually useless for analyzing the performance of the business. Pulse knows this so they rely on two key performance indicators: Cash EBITDA and Shareholder Free cash Flow. Here is the reconciliation from net income:

Pulse’s definition of free cash flow considers all capital expenditures are growth CAPEX. This treatment certainly has its merits as each participation survey targets an uncovered region for which their partner has an identified interest in. However, this is non entirely satisfactory to us as we feel some amount of CAPEX is likely necessary to support a given sales level. Luckily Pulse’s main competitor, Seitel, provides us with a key clue in their latest 10-K:

Pulse’s definition of free cash flow considers all capital expenditures are growth CAPEX. This treatment certainly has its merits as each participation survey targets an uncovered region for which their partner has an identified interest in. However, this is non entirely satisfactory to us as we feel some amount of CAPEX is likely necessary to support a given sales level. Luckily Pulse’s main competitor, Seitel, provides us with a key clue in their latest 10-K:

“Virtually all capital expenditures are additive to our library, as we have minimal true “maintenance” capital expenditure requirements. However, we estimate that approximately $25.0 million of net cash capital expenditures are required annually to offset declines in contribution from older data, depending on the areas in which customers are focusing their exploration and production activity.”

Seitel had $87.5 MM in net CAPEX for 2012, so the maintenance expenditure represented ~30% of the total spend. Taking 30% of Pulse’s $10 MM 2012 capital campaign gives us $3 MM for a maintenance CAPEX estimate basis going forward.

Valuation

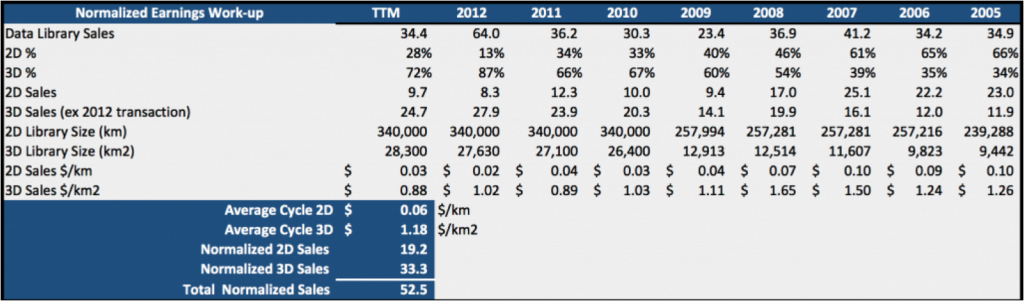

To perform a valuation, we need an estimate of Pulse’s normalized earning power. The easiest method would be to average earnings over a 7-10 year cycle but doing this for Pulse would ignore the fact Pulse has doubled in size over the cycle. To adjust for this, we will break Pulse’s sales into 2D and 3D, average the amount of sales each data type has generated over the cycle on a unit basis, and apply these factors to Pulse’s current library size:

Note that we have stripped out a single extraordinarily large transaction in 2012 of $27.8 MM for the analysis. For the valuation, we will assume a transaction like this will occur once during a 7-year cycle, which will add $4 MM to our estimate of normalized library sales.

Note that we have stripped out a single extraordinarily large transaction in 2012 of $27.8 MM for the analysis. For the valuation, we will assume a transaction like this will occur once during a 7-year cycle, which will add $4 MM to our estimate of normalized library sales.

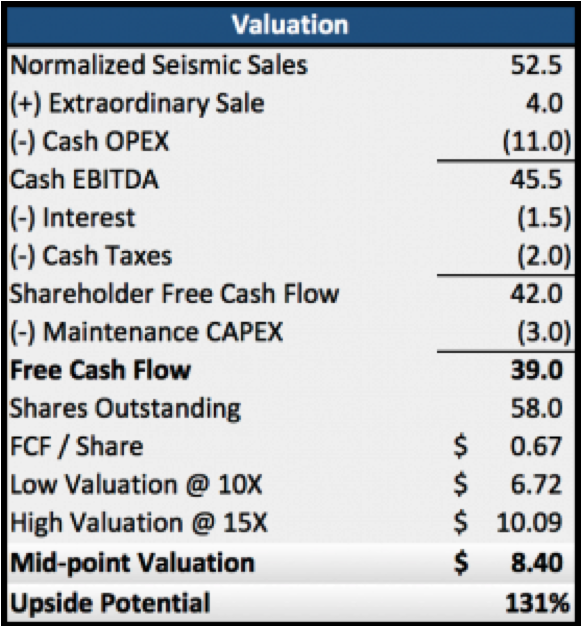

With an estimate of normalized library sales and maintenance CAPEX, we are ready to put it all together for the valuation:

I would argue at the absolute minimum a business such as Pulse should trade at 10X the amount of free cash flow available to shareholders. Given the economic characteristics of Pulse it wouldn’t be unreasonable to argue for a 15X multiple. With a midpoint valuation estimate of $8.40/share, Pulse appears to be quite undervalued at the current price of $3.64/share, offering well over 100% upside potential.

I would argue at the absolute minimum a business such as Pulse should trade at 10X the amount of free cash flow available to shareholders. Given the economic characteristics of Pulse it wouldn’t be unreasonable to argue for a 15X multiple. With a midpoint valuation estimate of $8.40/share, Pulse appears to be quite undervalued at the current price of $3.64/share, offering well over 100% upside potential.

Even if you believe sales will remain depressed, strip out the large transaction in 2012, and use the last three years as a basis for the valuation, the stock is still trading at a double-digit FCF yield. Given a bear case scenario of purchasing a high quality business at a double-digit yield, it’s not hard to see the downside protection here.

Capital Allocation / Insiders

Any company that converts 75% of its revenues into free cash flow is going to have a surplus of funds to allocate and what managements does with it is of utmost importance. And in this regard, Pulse’s track record has been excellent. Beyond paying a healthy 3.2% dividends, Pulse’s has three other avenues to allocate capital:

Share Repurchases – Pulse’s share repurchase activity would qualify it as cannibalistic – they practically devour their own shares. The repurchase rules are a bit different in Canada in that each company must submit a Normal Course Issuer Bid (NCIB) that limits repurchases to 10% of the float each year. And how much has Pulse been buying back? Since coming out of the crisis in 2010, they have purchased the maximum amount of shares every single year. This year they again renewed for – you guessed it– 10% of their float and though cash flow has been depressed this year, remain on track to complete the majority of the bid. Given the discount to intrinsic value their shares continue to trade at, we believe these repurchases will be highly value accretive.

Data Set Acquisitions – As mentioned previously, Pulse follows a disciplined approach to purchasing propriety data that can be seamlessly integrated into their existing library. They manage to avoid the integration costs and unrealized “synergies” that plague many corporate acquisitions.

Pulse’s last major dataset acquisition of Divescto’s library in 2010 exemplifies management’s excellent capital allocation abilities. Divestco, formerly one of Pulse’s few competitors, followed a reckless strategy of aggressively funding seismic surveys and attempting to undercut competitors on pricing. The downturn did them in, which allowed Pulse, one of the only companies with resources during a time of high industry uncertainty, to purchase their seismic library at absolute fire-sale prices. Pulse acquired 82,000 km of 2D data and 13,500 km2 3D data for $75.5MM, which using our previous figures, would have a replacement cost of $1.2 billion. As of last quarter, Pulse had already realized over 100% of their purchase price in library sales from Divestco’s data over the 3-year period, making the acquisition an absolute home run (though they had to pay $14MM in shares at depressed levels).

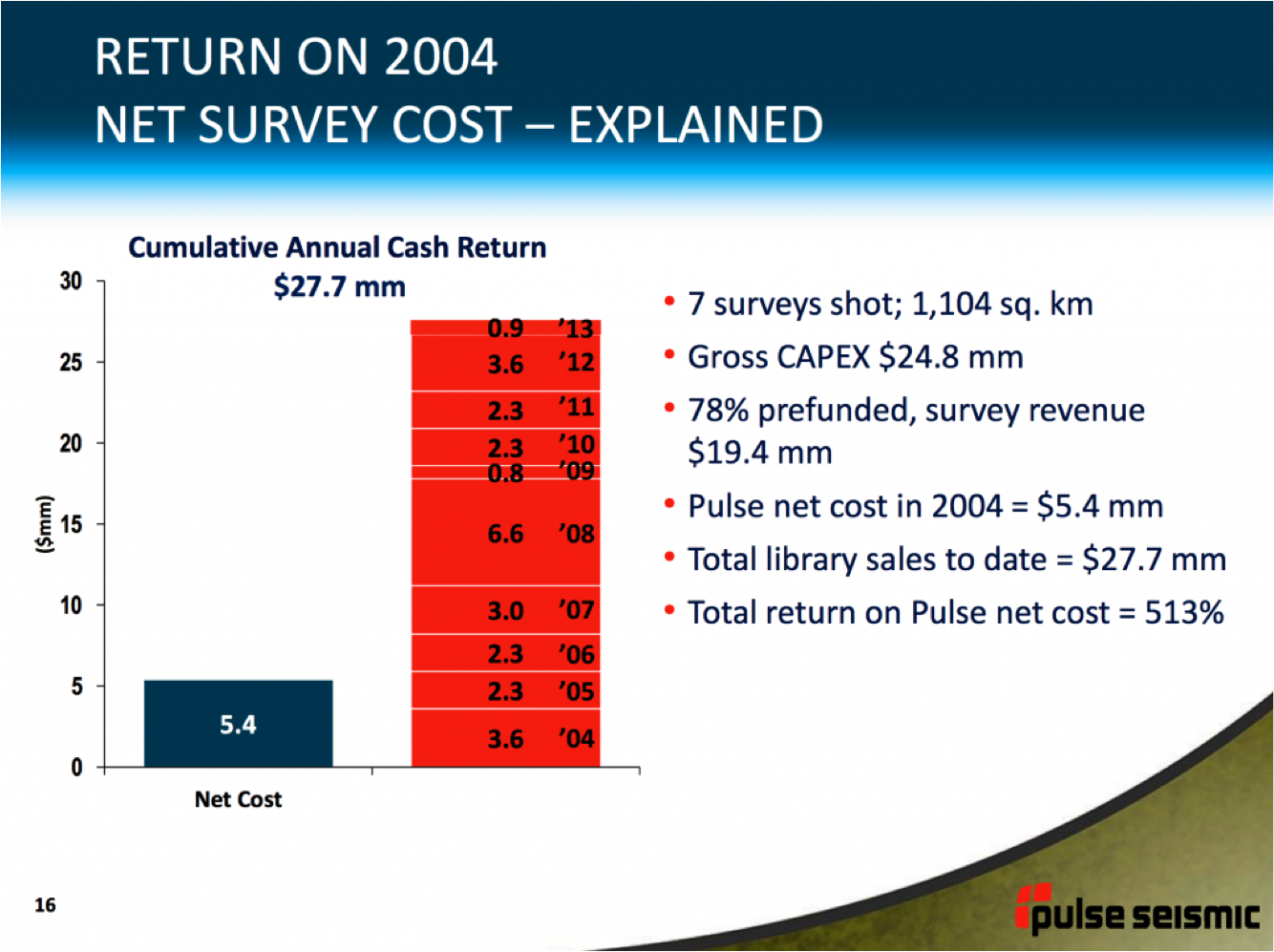

Participation Surveys – These surveys are Pulse’s main engine for organic growth whereby they partner with their customers to target attractive areas to shoot data and grow the seismic library. With Pulse’s customers fronting 70% of the bill on average, these capital expenditures generate enormous returns as shown in the ten-year performance of Pulse’s 2004 capital program:

Pulse generated an astounding total return of over 500% on their 2004 CAPEX spend. Pulse may have picked an exceptional year to detail but other slides in their Q2 Corporate Presentation indicate these surveys generate well over 100% returns on average year after year. Note these returns are presented on a sales basis but given Pulse’s high free cash flow margin, the returns to shareholders are still very, very attractive.

Pulse generated an astounding total return of over 500% on their 2004 CAPEX spend. Pulse may have picked an exceptional year to detail but other slides in their Q2 Corporate Presentation indicate these surveys generate well over 100% returns on average year after year. Note these returns are presented on a sales basis but given Pulse’s high free cash flow margin, the returns to shareholders are still very, very attractive.

Much of Pulse’s strong performance and diligent capital allocation can be attributed to the strength of their management team. Chairman Robert Robotti has been with the company since 2007 and owns 15% of the shares outstanding, a stake he has built up by open market purchases over the years (especially during 2010 when the stock crashed). Newly appointed CEO Neal Coleman and CFO Pamela Wicks are long time Pulse veterans and have recently been purchasing shares on the open market.

Management is paid reasonable salaries and are highly incentivized to create shareholder value. Brace yourself, as this system may very well be a first in the corporate world: management’s incentive compensation is based exclusively on the amount of shareholder free cash flow they generate per share. Pulse recently added the per share basis to account for large share issuances (as in Divestco acquisition) and it serves to support their aggressive repurchase program. No “adjusted EBITDA” here – Pulse’s management is paid directly in line with the economic returns to shareholders.

Catalysts

There are a number of catalysts on the horizon with the potential to fuel Pulse’s growth:

1) Recovery in the Local Oil & Gas Industry – surging oil & gas production brought about by horizontal drilling techniques has caused a glut of local supply, resulting in both crude and natural gas trading at discounts of up to 40% of their U.S. benchmarks this year. These wide spreads are unlikely to exist indefinitely and a number of large projects have been proposed to capitalize on the price discrepancies. If completed, LNG mega-facilities proposed by Chevron and Shell and TransCanada’s Keystone XL pipeline would all provide an outlet for the supply and likely stabilize the market.

2) Corporate Transactions – written into each of Pulse’s data licensing agreements is a non-transferability clause, meaning each user is required to have their own copy of seismic data. Corporate transactions such as joint-ventures, asset sales, and farm-outs of working interests all drive incremental license sales. With well costs skyrocketing for complex horizontal drilling campaigns, these transactions have become increasingly commonplace as drillers seek to fund large exploration program and mitigate risk. A few recent blockbuster deals have had a large impact on the company, including a single transaction that generated a $27.8MM sale in Q1 2012, over 20% of Pulse’s market cap at the time.

3) Mineral Rights Expiration – the mineral rights system in Alberta, where much of Pulse’s data covers, has a competitive system that benefits Pulse. All mineral right are awarded with an expiration date, typically between 3-5 years. This built-in onus drive demand for new seismic licensing as companies must either develop the property or attempt to monetize their assets through various corporate transaction should they run short on capital. All of these options result in more high-margin licensing sales for Pulse and with a record $7 billion in Alberta land sales over the last two years, there should be a strong pipeline of rights expiration-driven activity going forward.

Risks

In light of all these positive attributes, there are considerable risks worth discussing. Perhaps the biggest attribute separating Pulse from the prototypical Warren Buffet “hold forever” business is the lack of predictability of its cash flows. Pulse’s results remain tied to the exploration programs of oil & gas companies, which have been constrained following the recent collapse in natural gas prices, transportation bottlenecks, and widening spreads of local products. Alleviating the transportation bottlenecks will require long-duration billion dollar projects that may never be carried through, so it’s certainly possible industry uncertainty could remain for sometime.

Pulse’s business has also been exposed to considerable political risks. The proposed Keystone XL pipeline, which offers relief to the local supply gut, remains mired in political debate, and there is little visibility as to when or if the project will proceed. Adding to this, the Canadian government recently changed its stance on foreign direct investment causing a 90% decline in transaction dollar amounts this year. Pulse had counted on these transactions to drive sales in the depressed climate and there is no guarantee they will return to 2011-2012 levels.

Lastly, it’s important to remain vigilant of disruptive technology on the horizon that could permanently impair the economics of the business. Such a threat exists in NXT Energy Solutions (SFD.V, NLFDF), a Canadian company which through its patented stress field detection (SFD) technology, is able create a map of the subsurface for prospecting at a fraction of the cost of collecting seismic data (you can find a write-up on NXT and company presentation at MicroCapClub). The company’s technology has yet to receive widespread acceptance but could pose a material threat to Pulse’s legacy 2D seismic sales. Its important to note the technology cannot offer the precision that 3D seismic data offers, so the threat will likely be mitigated as Pulse’s business continues to move toward 3D licensing.

Conclusion

Finding a business capable of generating Pulse’s returns is rare indeed. Far rarer, is finding such a business available at a bargain price. Investors willing to look past near-term industry uncertainty will likely see a business poised to benefit from a recovery in the local oil & gas market and elevated corporate transaction volume as confidence is restored. In the meantime, investors are paid to wait as Pulse pays a healthy dividend, aggressively repurchases its own shares at depressed levels, and diligently adds high quality 3D data to prepare for an industry recovery. Nothing is for certain, but given Pulse’s competitive position and economic characteristics, we believe it’s more likely than not this wonderful business has many years of compounding left in it.

Disclosure: Long PLSDF