The Makings of a Ten-Bagger

In our recent article, we highlighted the importance of understanding where a stock is in the discovery process. The level of discovery can be the difference, after all, between finding a stock that provides a decent gain vs one that produces life-changing returns.

We have had the good fortune of discovering a number of these explosive stocks throughout our career, and one thing they’ve all had in common is fulfilling the type of criteria we look for. To demonstrate this, let’s look at one of our big movers over the last couple years, which we will call company XYZ for now.

Like many of the stocks we follow, it largely flew under the radar and went through its share of ups and downs before success caught up with it.

Discovery

We came across XYZ in 2016, having screened it using a mix of criteria that we have stuck with through the years. This includes looking for 25%+ year-over-year revenue growth, at least two consecutive quarters of profit growth, a small share float, little to no institutional investors and strong insider ownership.

At the time below are the financial metrics for what what we found:

- TTM Revenue: $4.698 million

- TTM Net Income of $1.199 million

- $0.05 EPS

- Previous TTM (The comp on year-prior) revenue: $3.49 million

- TTM Net loss of ($506,000)

- ($0.02) net loss.

- $2.7 million market Cap

- 24,703,244 I/O

- $0.11 share price…. Therefore trading at roughly 2.28x P/E on TTM.

- Working Capital $3.92 million – Trading below working capital

- $5.35 million Equity

- $1.195 million long-term debt

- $3.07 million cash.

- $2.17 million

The lows of 2019

We liked what we saw when we first looked, but this doesn’t mean it was smooth sailing from there on out.

In 2019, the company made the prudent decision to close a facility to save $800,000, consolidating production for a recent acquisition in Montreal. While the underlying fundamentals were still strong and future potential was promising, this led to a tough year for the stock as it reached a low of $0.09, with 24.77 million shares and a market cap under $3 M.

A quick snapshot from 2019:

- Revenue of $4.3 million vs $4.7 million

- Operating loss of $1.3 million vs $176,000

- Net loss of $1.27 million vs $95,000

- Cashflow operating loss of $435,000

The upswing of 2020

The dip proved to be short-lived, as is often the case with any company that has a solid underlying business and is already trading at an attractive valuation. Revenues went from $4.3 million in the previous year to $5.2 million, with full year profits moving from the $1.26 million net loss to a $965,000 net profit. And the company has been profitable every year since.

Revenues have now grown to a TTM Revenue of $7.8 million and a TTM Net Income of $1.7 million. And the stock price has reflected this journey, soaring well past $1 per share.

IBEX Technologies

The company is IBEX Technologies Inc. (TSX.V IBT), a Canadian-based success story that has built a compelling business model around developing and making proprietary enzymes for clinical diagnostics and contract manufacturing of enzymes for third parties. The company, based on MIT enzyme technology, was founded in 1986, listed on the TSX in 1995, and then proceeded to advance its business, with diagnostic and therapeutic products and a key acquisition.

If you bought at the low . . .

The stock recently hit an all-time high of $1.14. In other words, a 10 X gain in under 5 years. Even if you were conservative and waited for a FY of profitability (i.e., the end of 2020), you would have bought in around $0.25 ($6.19 million market cap), with a 6.4 P/E with arguably much less risk. And you’d be looking at almost a 5 X gain in under 3 years.

The question, of course, is what would you have done?

The challenge with nano, micro and small caps is, first of all, finding the good ones with real potential for growth. They are most definitely out there, as we have proved many times, but even when found retail investors tend to hang back, either through fear of volatility or because they need to see other others (e.g., institutional investors) jump in first.

Would you have bought the stock at the low if you knew it met some of our criteria? Where on the way would you have found it? And are you screening for the right metrics?

In just a couple years, the reward was either a 5 X profit waiting for FY profits or 10 X for those following closely. And today, the stock still holds considerable value, trading at a P/E of 14 X, an EV/E of 9.7, and annualized profit metrics of P/E 6.7 X and EV/E 4.6 X.

Imagine discovering this stock before, during or even slightly after the 2019 lows, knowing that it had solid fundamentals and a growth trajectory. And if you bought at the low, that dip would have been both a test in patience and a buying opportunity. It’s all about knowing what you are buying and then staying the course.

There’s always the next one

The good news is that IBEX is far from the only one with 10-Bagger potential. In fact, it’s a case study in what kind of opportunity we’re all about.

These 10-Baggers are out there—you just have to know what they look like before they lift off. They have solid financials, a good growth trajectory, and virtually no exposure. They fly under the radar for most investors, being too small to attract institutional money and the mass of retail investors who often follow.

We find these gems on a regular basis, uncovering them through a screening process that looks for the criteria mentioned above. Of course, a bit of luck is always involved, but as the saying goes luck is what happens when preparation meets opportunity.

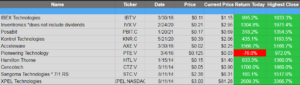

Some of our successes over the years include:

We’re always on the hunt for the next 10-Bagger. This could be one of the stocks in our watch list, one of the stocks in our portfolio, or a new one we have yet to discover. Regardless, the smallcap space is where you will find this type of opportunity, and we’ve honed a tested and proven approach to uncovering the next big winner.