Smallcaps, microcaps and nanocaps provide the ultimate high-risk, high-reward scenario. This part of the market is where ideas live or die. It’s where the Apples and Amazons of the world get started and where new breakthroughs and innovations get traction.

Investing in this space takes patience, courage, and some luck. It’s not for the faint of heart, so it’s understandable that these small companies are often treated like lottery tickets by retail investors, who don’t know how to properly navigate the space.

If investors learn just one thing that could help them succeed in the smallcap universe, it’s a better understanding of the relationship between cash and shares, and how a lack of the former often leads to an increase in the latter.

Inflating away your investment

In the same way that excessive central bank money printing dilutes the value of your currency, via inflation, so does issuing more shares without any other corresponding increase in a company’s value.

Share inflation, or dilution, is incredibly common in the microcap world. In fact, it’s normal. Most of these companies are not profitable. This means they need to raise capital, and they do this in two ways: debt or shares.

Issuing debt is never an easy process, as the terms can be difficult. And in this high inflationary environment, with its challenging debt servicing costs, forget it.

The preferred method for raising money—by far—is issuing shares. You see this all the time. Think junior mining exploration companies, who regularly issue shares to finance seasonal drill programs, only to do it again and again unless they become one of the extremely lucky, 1 in 1,000 companies to hit a big deposit. Yes, their market cap may go from $10 million to $100 million, but if their shares also increase by a factor of ten, no one wins.

Of course, this challenge goes well beyond mining exploration to every corner of the microcap market. It’s very difficult, after all, to be flush with cash for companies that are just getting started, and the reality is that investors usually end up footing the bill.

Financing in the current market

To add to the difficulty, getting financing in the current market is brutal.

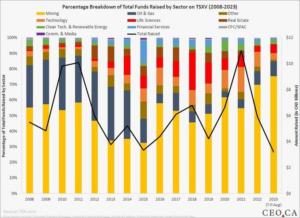

As the chart below shows, funding for companies on the TSXV is lower than it has been in years. The cost of capital has risen, and as a result people are much less risk oriented. The appetite to finance riskier investments is just not there. This has very negative ramifications as it means that companies who have no choice but to issue shares to fund their operations are currently doing it in unfavourable conditions, and at much lower valuations.

Going back to the market for funding can be very expensive. For instance, raising $1 million in shares is not the true cost of financing. When conditions are challenging, as they are now, you can get bad shareholders who know they have the upper hand with a company that serially dilutes, selling and driving down the share price. There’s also considerable cost involved among the leadership team, who spend significant time hunting for money. Then there’s commissions on financing, legal and accounting fees, sweeteners like warrants, an IR firm, and more.

Going back to the market for funding can be very expensive. For instance, raising $1 million in shares is not the true cost of financing. When conditions are challenging, as they are now, you can get bad shareholders who know they have the upper hand with a company that serially dilutes, selling and driving down the share price. There’s also considerable cost involved among the leadership team, who spend significant time hunting for money. Then there’s commissions on financing, legal and accounting fees, sweeteners like warrants, an IR firm, and more.

The result could mean getting a bad price on a new share issuance, requiring even more shares, and excessive numbers of warrants (which means more shares).

Hard lessons

Even in good times, there are countless examples of excessive dilution in all corners of the smallcap space.

For a recent example, take Voxtur Analytics Corp (VXTR.V). They closed a large private placement, issuing shares at $0.20. The market, sensing more dilution without enough positive momentum, responded by dropping the stock 50%, and now every shareholder is holding the bag.

We’ve all been here, but thankfully there is a way to reduce the risk of this happening to you again.

To start, don’t get caught up in hype. No matter how you’ve heard about a company, whether through your own research or from a friend’s hot stock tip, look under the hood before you even think about purchasing.

Look for $, and look at shares

We have covered the factors we look for in a stock many times. These include year-over-year revenue growth, consecutive quarters of profit growth, high insider ownership, and a small share float.

To be even more specific, we recommend looking for strong year-over-year revenue growth of at least 25% per share. This shows that something is working and that investors are benefiting. You can read more about this in our article on Multiple Expansion.

If revenue, profit, and insider ownership are all good, then a small share float is often the result. This is because there is little or no need to issue more shares to fund operations as the company is making money. In some cases profitable companies sometimes use their cash to buy back their shares, the opposite of share dilution, shrinking the number of shares outstanding and increasing shareholder’s percentage ownership of the company.

We’ve often stated to look for no more than 30 million shares outstanding. While this is good in the sense that it gets you thinking along the right lines, there are other factors at play. For instance, a company may have 150 million shares outstanding, but also a great cashflow, good profit, a great market fit, and strong insider ownership.

As a rule of thumb, however, less is more when it comes to shares outstanding. Especially if it’s accompanied by profitability. Any increase in demand for the shares could send the share price rocketing as demand outstrips supply.

Find the gems

As we noted in our article on navigating the microcap space, only a small fraction of the 2,700+ listed companies in Canada are microcaps that meet all or most of our investment criteria.

You can find these companies if you stick to the strategy we’ve outlined. It’s simple, and it works.

Ian Cassel highlighted this quite clearly during his presentation at our recent SmallCap Discoveries Conference. For his example, he drew on XPEL, a company we highlighted a number of years ago and which made incredible returns for early shareholders. As Cassel notes (at the 16-minute mark), XPEL managed to return 150,000% in just 14 years—with only 7% dilution.

Another more recent one is AirIQ (IQ.V). We highlighted this unique company a couple years ago, liking its model and the way it valued its shares, with little dilution. The stock has doubled this year, and the shares outstanding have even shrunk. It continues to grow and add money, and because of the lack of dilution shareholders are reaping the rewards.

There are many more great examples—and many more to success stories to come.

It comes down to good management

In the end, you are looking for a management team that treats all resources, especially its shares, like gold, not toilet paper. You’ll see this in the numbers, with one of the best indicators being profit and revenue growth, and a low share count.

Good companies attract good shareholders, who have done their homework, understand what they bought, and have bought for the right reasons. The reward is increasing shareholder value and the growth of a successful business.

While they can feel like a drop in the ocean, these companies are out there, and if you know what to look for you will find them.