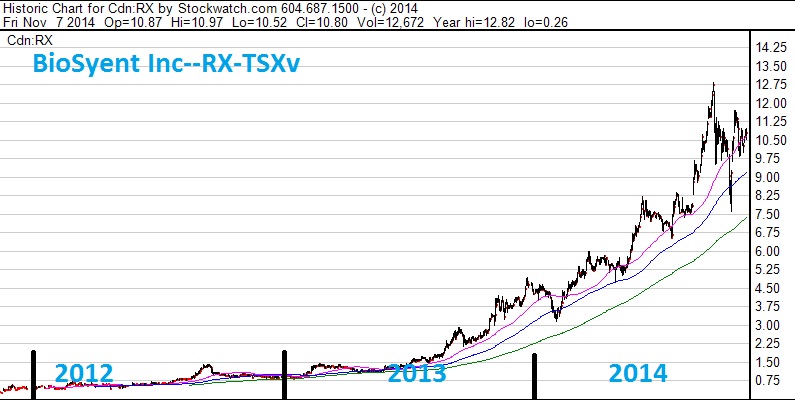

Biosyent (RX.V)

• Biosyent licenses and markets specialty pharmaceutical products in Canada

• They stick to proven, approved drugs and risk no money trying to create their own.

• We first got into Biosyent at $1.20 in May of last year after we became convinced the CEO was top-notch and could grow the business 50+% per year.

• The company delivered quarter after quarter and became a “must own” for small-cap funds in Canada.

• The stock has risen over 800% from our original purchase and the business shows no signs of slowing down – Biosyent’s chart really is a thing of beauty.

Microbix Biosystems (MBX.TO)

• Microbix manufacturers strains of viruses (Dengue fever, Rhubella, etc) for disease testing kits

• They also have three technologies, including LumiSort, a new process engineering animal semen for a particular sex – i.e. a dairy farmer could be guaranteed all female offspring

• We found Microbix when it was under $.20 after a decent and profitable quarter – the market believed it would’t keep making money and was jittery about a lawsuit overhang.

• Late January brought us lots of good news: MBX won their lawsuit, kept making money, and raised cash to make LumiSort a reality. The stock went up 250% in a matter of days.

• With an update on LumiSort due out in two weeks, insiders have been buying and so have we – the stock is now up almost 300% from our first purchase.

Covalon Technolgies (COV.V)

• Covalon makes anti-bacterial wound care products, such as films for the skin and IV coatings

• The company’s products provide a comfortable covering for the patient and help prevent infections while they receive care.

• We thought Covalon might be toast in August last year with the stock at $.14 and the company running out of cash – until they delivered a blow out quarter of $0.03 per share in earnings and we saw insiders buy a big chunk of the stock.

• We began buying and just two months later, Covalon announced a major licensing deal with Molnycke, the $3B leader in the wound care space.

• COV’s growth has been impressive until hitting a snag this last quarter – the stock is down big, but still over 8X our original purchase price.

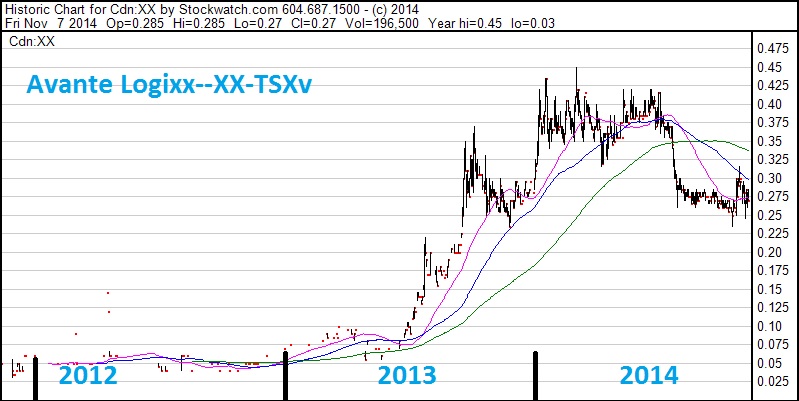

Avante Logixx (XX.V)

• Avante Logixx provides high-end security services for families and businesses in Toronto

• They offer services like responding to homes after a break-in (guaranteed in 6 minutes of less!) or accompanying corporate executives on a product launch event in Africa.

• We first bought Avante at $.10 in 2013 after a strong quarter and noticed a respected Toronto business man had come on board to engineer a turnaround and was buying stock

• The new CEO cut costs, drove growth, and brought the stock to life – it hit at high of $.45 in February of this year and they were able to raise $5M from institutions to go after acquisitions.

• These institutions headed for the exits following a soft quarter in July, but Avante is still up over 2.5X our entry price. And with $6M in cash on hand for acquisitions, we still like this one.

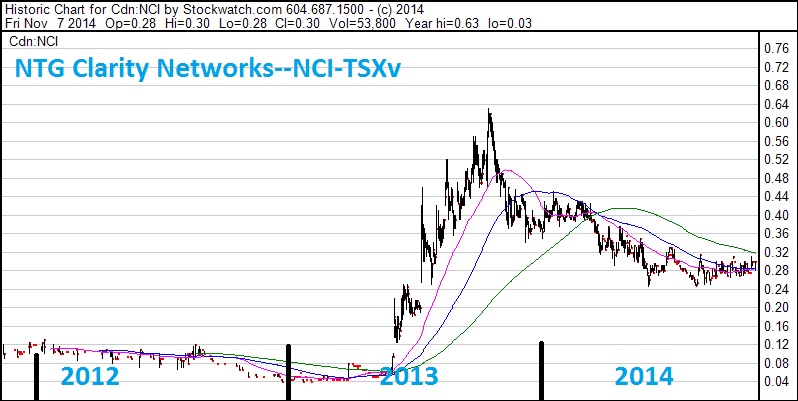

NTG Clarity Networks (NCI.V)

• NTG Clarity Networks makes software for telecommunication companies.

• Their solutions help telecoms manage all parts of the business – orders, inventory, billings, etc.

• We got into NCI under $.10 in May of last year because they were experiencing huge growth abroad and trading at an absurd multiple – under 4X earnings.

• The stock flew to $.60 after the CEO set lofty targets for growth. We went cautious and took most of our position off the table.

• Miss after miss, the market lost faith in management – the stock has broken down and we can’t get comfortable with NCI again.

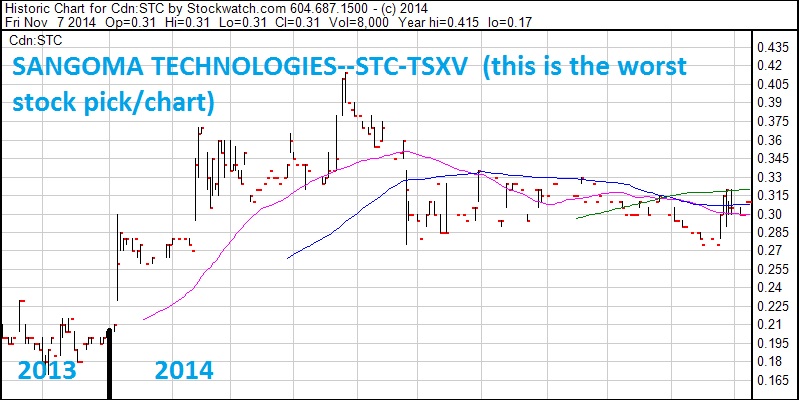

Sangoma Technologies (STC.V)

• Sangoma makes technologies that allow all devices in business to communicate together – computers, phones, iPads – you name it.

• A shift from phone to internet communication nearly killed Sangoma – they had to spend the last three years engineering 50+ new products to stay alive.

• We first got into Sangoma earlier this year at $.28 because it was cheap, loaded with cash, and growing fast (30+%).

• What we missed is that all the growth from new products was soon to be negated by declines in their legacy business

• We admitted we were wrong and exited after growth stalled, the stock moved sideways

3 Comments.

Can you put a date in all your articles? Otherwise readers can’t be sure how timely they are.

Thanks.

Do you think Avante Logixx is a good buy at this price after the pullback from recent highs.

This is an excellent well written article. Very much worth reading in my humble opinion.

RX and MBX look to have some compelling long term growth potential. Particularly RX. They remind me of Paladin, which had an incredible run before they got bought out. Wish RX published their sales by product in their quarterly report. They need to get traction beyond their FeraMax products and I really cannot tell if that is happening. But they have very good management, a reasonable moat, and I am pretty confident they will do well over the long run. MBX has a lot of potential and appears to have a good business moat. But they have material execution challenges ahead. XPEL’s success was a bit of a surprise to me. They have a good product and can scale rapidly and inexpensively. The surprise is that there was a lot of demand and a bigger market than I suspected. Their software and database provide somewhat of a moat, which helps.

Look forward to your future discoveries in this space.